When it comes to savings and investing in Canada, two tools pop up all the time: the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA). Confused about the difference between RRSP vs TFSA options? Well, both are great, but they work differently. Depending on your situation, one may make more sense than the other, or maybe both in tandem.

Let’s break them down so you can figure out which aligns best with your goals.

RRSP vs TFSA: What are they?

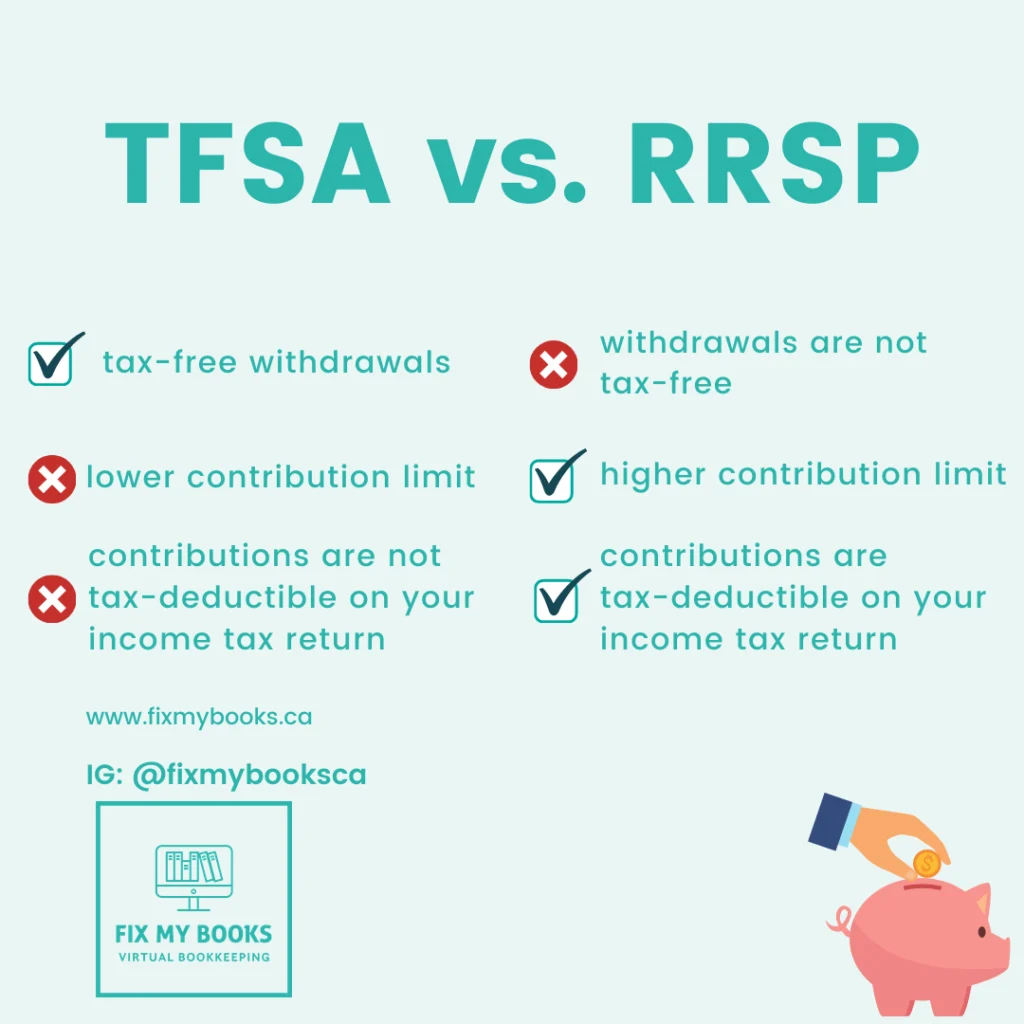

| Feature | RRSP | TFSA |

|---|---|---|

| Purpose | Primarily for retirement savings. Contributions are tax-deductible. | Flexible savings & investment vehicle. Contributions are not tax-deductible, but withdrawals are tax-free. |

| Contribution limits | Based on your income, up to a limit set by CRA each year. Unused contribution room carries forward. | Also limited annually; unused room carries forward forever. |

| Tax treatment on contributions | Reduces taxable income in the year you contribute. | No deduction. |

| Tax on withdrawals | Withdrawals are taxed as income (unless in specific cases like RRSP → RRIF transfers). | Withdrawals are not taxed. |

| Ideal use | For people expecting to be in a lower tax bracket in retirement vs now, those earning more today. | For shorter-term savings, emergency funds, or for people who expect to have similar or higher tax rates later; and for flexibility. |

How to decide which makes sense for your situation

When comparing RRSP vs TFSA as savings options, there are some key considerations. Think of these questions like a checklist:

- Your current tax rate vs expected future tax rate

If you’re in a high tax bracket now, an RRSP may give you more immediate benefit by reducing your taxable income. If you think your income (or tax rate) will be higher in the future, the TFSA could be more advantageous, since withdrawals are tax‐free. - When you’ll need the money

TFSA gives more flexibility: you can withdraw anytime without penalty or tax (though you don’t get the contribution deduction). RRSPs are generally built for long-term/retirement; early withdrawals are taxed (and sometimes penalized). - Savings goals & flexibility

Do you have both retirement and shorter-term goals? Could use a mix: RRSP for retirement, TFSA for emergencies, big purchases, etc. - Maximizing employer matching and other incentives

Some companies or plans may match RRSP contributions, which boosts the benefit. Also, if you expect to convert RRSP into a RRIF or pension income, consider how taxable income in retirement will look. - Room & unused contributions

If you haven’t used all your TFSA room, that’s “free space” to grow investments tax-free. Same with RRSP – unused contribution room carries forward, but be careful with over-contributions (they can incur penalties). - Income stability & cash flow

If your income fluctuates, you may prefer the flexibility of a TFSA. RRSPs generally tie up money until retirement, or penalize/charge tax on withdrawals.

When combining both is smart

Although we’re comparing the differences between RRSP vs TFSA options, you don’t always have to pick just one. Many members benefit from using both:

- Use RRSP first if your tax bracket is high now, to reduce taxable income.

- Use TFSA for savings you might need sooner, or to create a cushion for emergencies.

- Later in life, you might convert an RRSP into a retirement income account (e.g. RRIF), and use TFSA withdrawals for flexibility.

Potential trade-offs & pitfalls: RRSP vs TFSA

- With RRSPs, withdrawals are taxable. If you withdraw early, you lose both the tax benefit and face taxes.

- Over-contributing to RRSP or TFSA leads to penalties. Keep track of contribution room.

- Investing inside these accounts matters: both benefit more if you put higher growth investments inside them, but also riskier ones must match your risk tolerance.

What we recommend

At Luminus Financial, we believe in helping you make choices grounded in your life and goals, not just in the numbers. Here’s how we suggest you approach the decision:

- Stop by or talk with one of our advisors to map out your income now vs expectations in retirement. They can also walk you through the differences between RRSP vs TFSA options.

- Think about how soon you might want access to your funds (e.g., for home, children, travel).

- Consider tax planning: RRSPs are powerful tools, but only if you plan for what income looks like later.

- Use calculators (like ours) to model “what if” scenarios: e.g. “if I put $X in RRSP vs TFSA now vs split”.

Bottom line

If your priority is reducing tax today and preparing for retirement, RRSPs often win. If you want flexibility, tax-free growth, and access when you need it, a TFSA may be the better bet. Most people will use both over their lives, but you should compare the benefits of an RRSP vs TFSA option for your personal use case.

What’s most important is understanding your savings goals, tax situation, and timeline. With that clarity, you can make choices that work for you.