Saving money isn’t always easy, but it matters. Did you know that nearly half (49%) of people have just enough to cover a few months of expenses? If any emergency expenses come up, things can go downhill fast. The challenge isn’t necessarily income; it’s clarity and making saving money a habit. But here’s the good news: small, consistent actions can build your financial confidence even when starting feels impossible.

Understand Your Money Mindset

Before anything else, you should understand your mindset and reasoning for wanting to save. Saving can trigger emotional responses like fear, guilt, or obligation. If you’re saving out of fear (“I need to start saving money because I’m bad at managing my finances”), you’re less likely to stick with it long term. Instead:

- Reflect on your “why.” What are you saving for? A vacation, a home down payment, retirement, or freedom from debt?

- Make it meaningful. A purpose-driven savings goal is far easier to stay committed to.

Our Infinite Savings Account offers higher interest and no fees on deposits, making it a smart and simple choice for purposeful savers. Pair it with meaningful goals to stay motivated.

Track & Assess Your Habits

The first essential step: know where your money goes.

- For 2–4 weeks, log every purchase. That includes coffee, transit, groceries, gifts, and yes, cash tips.

- Organize expenses into Needs, Wants, and Savings.

- Be sure to capture “invisible” cash spending! Those transactions often slip by unnoticed but can add up quickly and should be considered in your monthly spending.

Tracking like this sheds light on real spending patterns and helps identify easy areas to save, and can even inform the approach you take when it comes time to start building your budget.

Build a Budget That Works

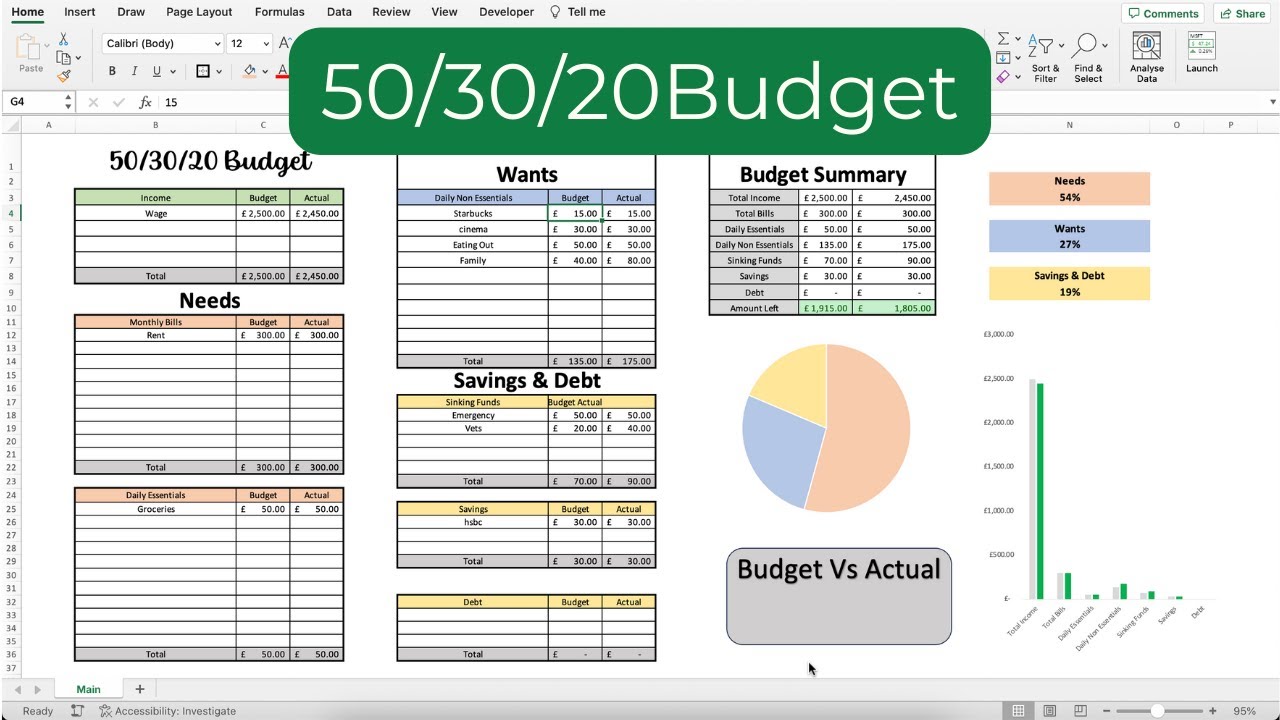

There’s no perfect budget, but here are two effective strategies:

- Zero-based budgeting. Assign every dollar a purpose: Everything from rent and groceries to a fun budget and any additions to your savings, so income minus expenses equals zero.

- 50/30/20 rule. Split your income: 50% needs, 30% wants, and 20% directed toward savings or debt repayment.

Then, review and adjust monthly. A realistic and flexible budget empowers you to adapt as life changes.

Start Small, Automate, Build the Habit

- Choose a percentage. Commit to save, say, 10% of each paycheque or more so that as your income grows, so does your savings account.

- Automate it. Set up a recurring transfer to your savings account or TFSA on payday.

- Be patient. Even modest, regular savings accumulate. It’s not about perfection, it’s about consistency!

“Paying yourself first” by automating savings before expenses is the foundation for long-term financial wellbeing. Automation will also help ensure you don’t miss dropping funds into your savings each month and can help make saving money easier.

Cut Costs Without Feeling Scared

You can save without sacrifice:

- Pause before big purchases. Give yourself a 5–7 day “cooling-off” period.

- Try a no-spend week/month. Only essentials (groceries, bills) are allowed.

- Reduce recurring fees. Cancel unused streaming services or renegotiate mobile and utility plans.

These tactics reduce spending fatigue and break unhealthy patterns in a sustainable way.

Reward Yourself Responsibly

Set up a simple “Treat Yourself Tax”: whenever you spend on something non-essential, transfer the same amount into your savings. This lets you enjoy small indulgences while reinforcing your habit! The key is elimination through reward, not deprivation.

Monitor Progress & Realign Goals

- Monthly check-ins. Review your budget, transfer amounts, and progress toward goals. Adjust as needed.

- Celebrate milestones. Whether you’ve hit your 20% savings goal, finished a no-spend week, or automated your savings, acknowledge it! Celebrating your wins can encourage you to continue building on good habits.

- Scale responsibly. Once you’re comfortable, upgrade to tools like Luminus’s TFSA or RRSP savings plans. Our members also benefit from knowledgeable Luminus advisors offering tailored guidance.

Saving Money Can Be Simple!

Let’s recap:

- Reflect on your why

- Track your spending

- Build intention-driven budgets

- Automate your savings

- Eliminate unnecessary costs

- Celebrate every win

If you think you can’t save now, this is your proof you can! You don’t need big changes. Incremental steps and meaningful habits have a lasting impact and make it simple for you to start saving money.

Your Next Steps with Luminus Financial

- Open a high-interest savings account: Choose from Classic or Infinite Savings Accounts, with our TFSA earning 1.60% interest.

- Book a goal-setting session: Our advisors can guide you through TFSA, RRSP, and saving strategies suited to your ambitions.

You might feel stuck now, but by starting small, automating, regularly checking in, and celebrating progress, you’re building momentum. Saving becomes less about restriction and more about progress. At Luminus Financial, we’re right beside you, every step of the way. Let’s get started together.